What we're talking about:

Bitcoin UTXO Management Tips to Save On Bitcoin Fees

Bitcoin successfully overcomes the double spend hurdle through its handling of Unspent Transaction Outputs (UTXO). This clever system allows for bitcoin to be used like digital cash, without the need for 3rd party intervention. Acquiring many UTXOs in your wallet may feel great, but in reality, the accumulation of small-value containers could come back to haunt you when you least expect it.

The following are a few UTXO management tips that can help save on bitcoin fees and even speed up your transactions.

Understanding Bitcoin Fees and Dust

Managing your UTXOs begins with a basic understanding of Bitcoin fees and dust. Cutting down on these two elements is the trick to effective capital management on the blockchain.

Fees are paid to miners for organizing blocks and recording transactions on the blockchain. These mining fees are calculated on the basis of data size and network activity, not on the value of the actual amount being transferred. This is why sending a high-value, single UTXO during moments of quiet network activity can cost less in fees than sending a small-value payment, consisting of multiple UTXOs, during a busy period. Each additional UTXO added to your payment increases the data size of your transaction. Note that this is applicable for on-chain transfers; sending your bitcoin out of your exchange account is usually subject to a flat fee imposed by the exchange.

Dust refers to very small-value UTXOs. We’re talking satoshis here, not full coins. Some bitcoin wallets may even ignore these UTXOs when combining UTXOs to form a payment. A payment made up of several dusty UTXOs could end up being a costly surprise.

Label Your Coins

If you’re just starting off in Bitcoin, a simple wallet is usually the best way to go. These types of wallets, especially the mobile ones, provide a streamlined user experience but don’t go very far when it comes to extra features.

Once your Bitcoin journey brings in more satoshis, you may want to consider a more advanced wallet which offers additional features. One such feature is the ability to break down and label your holdings into individual UTXOs. This is also a handy way to manage a combination of anonymous coins with KYC flagged coins.

While labeling your coins is a foundational step in managing your bitcoin wallet, another key aspect involves how you acquire bitcoin. This brings us to the strategy of dollar-cost averaging (DCA), a method that balances out market volatility.

Purchasing bitcoin Through DCA Strategies

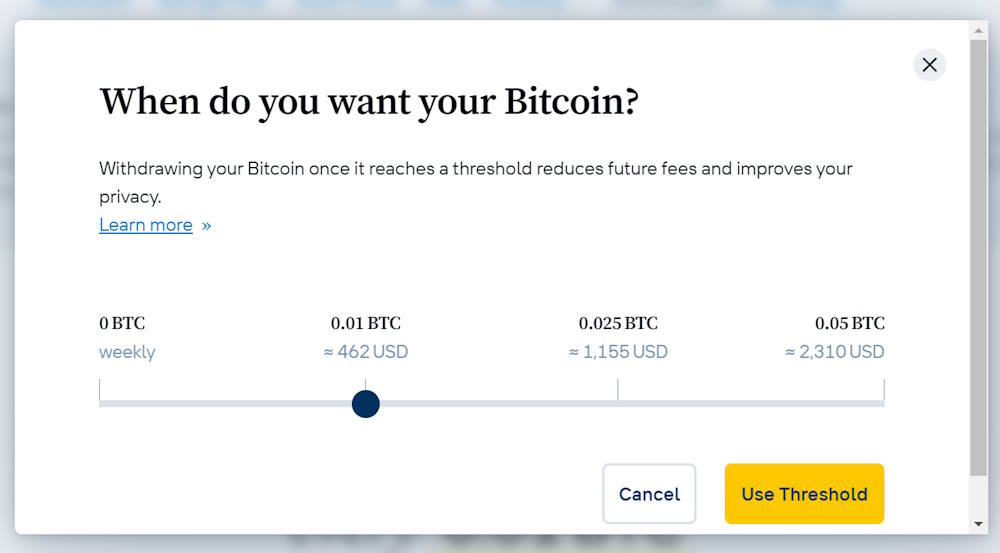

Purchasing bitcoin through dollar-cost averaging (DCA) can help mitigate its volatility to some extent. However, sending small-value UTXOs out every single day may set you up for future problems. Therefore, it could be beneficial to lower the frequency of your DCA withdrawals.

Defer Your DCA Withdrawals

While we’re constantly reminded of the risk of leaving bitcoin on an exchange, the build-up of small-value UTXOs in your self-hosted wallet could turn out to be an economic hindrance further down the line. Finding the right balance between self-custody and effective UTXO management is ultimately up to you as a sovereign individual.

Automated UTXO Management

Using services like Swan Bitcoin can further optimize your UTXO management. Swan Bitcoin offers an auto-withdrawal feature that allows you to set thresholds for automatic bitcoin withdrawals to your wallet. For instance, you can choose to auto-withdraw weekly or at intervals like 0.01, 0.05, 0.25, etc. This feature can be incredibly helpful in managing the size and frequency of your UTXOs, ensuring that you consolidate them effectively without constant manual intervention.

Get $10 free bitcoin from Swan – New accounts only. No purchase necessary.

Consolidate Your UTXOs

Once you’ve accumulated many UTXOs, there’s not much you can do about it. A trick you can try is to send your money back to yourself. Such a transaction basically consumes all UTXOs, deducts a transaction fee, and returns the rest as a single UTXO back to your receiving address. While it may seem counterintuitive to pay money to save money, this puts your bitcoin in a more efficient state for future spending. If you need to make a payment in a hurry, you won’t have time to wait for the network activity to calm down. Naturally, it makes sense to do this type of consolidation when fees are low.

Use a CoinJoin Mixer

Mixing bitcoins has its benefits for maintaining privacy on the blockchain but it can also act as a consolidation technique and help with your UTXO management. Do be careful though and always do your own research. With the rise of cryptocurrency money laundering, mixing protocols are under intense scrutiny, as seen with the sanctioning of Ethereum mixer Tornado Cash.

Lightning Network

Finally, if spending small amounts of bitcoin is part of your strategy, you may want to consider taking some of your holdings onto the Lightning Network. This second layer payment solution to Bitcoin’s base layer offers ultra-fast payments at negligible cost.

Is It Worth the Effort?

UTXO management is a useful way to maximize the efficiency of your bitcoin payments. Its necessity however depends on your personal circumstances.

If you’ve only sent a few transfers from your exchange and are sitting it out for the long haul, worrying about every UTXO is probably not worth the bother. However, if you’re running a Bitcoin business or transacting in bitcoin on a regular basis, these little tips and tricks might just end up saving you some time and money further down the line.

We’re excited to have you join us on this journey and we look forward to helping you understand the true appeal of Bitcoin and all the freedom it can bring with it. Our partners and resources include affiliate relationships with companies we trust and believe in, to ensure that you have the best experience possible. Thank you for choosing our website as your go-to resource for all things Bitcoin.

What we're talking about: